Chip in the Sleeve, or How Dual-Use Goods End Up in Russia Thursday, 09 May 2024

In 2022-2023, the export of European and American goods to many countries friendly to Russia or neutral increased significantly. "Excess" supplies would be enough to fully compensate for Russia’s "losses".

This also applies to products necessary for the production of weapons: exports of these categories increased by six billion dollars ― about the same as supplies to Russia fell after the start of the full-scale invasion, according to the calculations of New Europe.

We tell you how dual-use goods get from Europe and the United States to Russia and whether the West is able to fight the circumvention of sanctions.

In 2024, Russian business faced serious difficulties. Due to the threat of secondary sanctions, the largest banks in China, the United Arab Emirates, and Turkey have stopped accepting direct payments from Russia.

Not only the supply of parallel imports and sanctioned goods, but also ordinary purchases were under attack.

Most of the goods from China, not prepaid in advance, are stuck, since buyers cannot pay for the goods, a customs broker and a logistics specialist told Novaya Europe on condition of anonymity. Restrictions are very sensitive for them. By 2024, China has become Russia’s main trading partner, accounting for more than 40% of all imports to the country.

Nevertheless, bypass schemes have already begun to appear.

Deliveries are made to formally unrelated companies in Kazakhstan and other countries friendly to Russia. "And banks take the initiative, build their own chains and make payments according to the so-called "bank agent" scheme," explains a top manager of one of the logistics companies. That is, payments are made through companies and banks from third countries, which charge interest for their services.

The current suspension of payments and imports is just a temporary hitch, experts with whom Nova-Europe spoke are sure.

"It is impossible to stop financial settlements a priori. This is an absurd idea. You can only increase the cost of operations, transaction costs," says economist Dmitry Nekrasov. "If the United States more consistently puts pressure on or imposes sanctions against financial institutions, then the creation of another bank specifically for Russia will be good business, people will make money on it."

Moreover, this applies not only to Russia’s open allies, but also to Western countries that turn a blind eye to numerous loopholes in the sanctions regime in order to continue supplying their goods.

Eternal transit

Before the attack on Ukraine, the European Union was Russia’s largest trading partner. In 2021, according to the Federal Customs Service (FCS), every third product was imported into the country from Europe. In total, goods worth 89 billion euros were imported to Russia, according to Eurostat data.

With the outbreak of the war, exports from the European Union collapsed. In 2022 - by almost 40%, to 55 billion euros. In 2023, it will increase by 60% compared to 2021. This is 38 billion euros. Now in Russia, direct imports of European goods are as rare as in the early 2000s.

Medicines and pharmaceuticals (this is a fifth of imports), equipment, tools, alcohol, and chemicals are still supplied from the EU to Russia. But imports from Europe continue to decline. In January 2024, 27% less goods were officially imported into the country than in January 2023.

Exports to Russia from the United States have always been significantly lower than in Europe. In 2021, according to the Federal Customs Service, the States accounted for only 5.7% of imported goods. This is $16.9 billion. Moreover, according to the United States itself, they exported even less directly, only $6.4 billion.

After the start of the war, trade relations not only deteriorated, but almost zeroed. In 2023, only $600 million worth of goods were directly brought from the United States to Russia. There was no lower level in the 1990s either.

It would seem that the relationship is destroyed. Russians can no longer receive Western goods and technologies. However, in practice, of course, everything is not so. European and American goods still go to Russia, only through other countries, more expensive and longer.

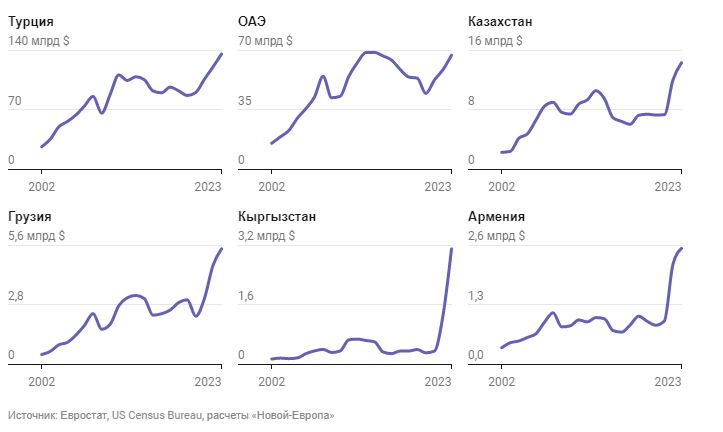

In 2022-2023, the export of European and American goods to many countries friendly to Russia or neutral increased significantly.

Compared to the previous trend five years before the full-scale war:

- exports to Kyrgyzstan increased by almost 7 times;

- to Armenia - 2.6 times;

- to Kazakhstan and Georgia - by 1.7 times.

Страны-лидеры по относительному и абсолютному росту импорта из ЕС и США

How we calculated

_

We downloaded trade data from the websites of Eurostat and the US Census Bureau, which deals with statistics in the United States. Initially, we used data for all countries of the Caucasus, Central Asia, the Balkans (except for those that are part of the EU), as well as Turkey and the UAE.

_

We then compared the volume of imports of goods in 2022 and 2023, but not with previous years, but with the trend line. We built it using the method of least squares, based on data on imports for five years ― from 2017 to 2021. As a result, we excluded Turkmenistan, Kosovo and Mongolia from the analysis – imports to these countries from the EU and the United States did not increase.

_

To assess the export of dual-use goods, we built two trends – based on data for 2012–2021 and for 2017–2021 — and used the trend that was closest to the real data for each country.

_

The full list of countries we studied are: Armenia, Azerbaijan, Georgia, Turkey, Serbia, Kosovo, Montenegro, North Macedonia, Bosnia and Herzegovina, Moldova, Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan, Turkmenistan, Mongolia, United Arab Emirates, Belarus, Russia.

_

This calculation method is a forced measure, since with the beginning of the invasion of Ukraine, Russia stopped disclosing detailed customs data.

In monetary terms, during the first two years of the war, imports of European and American goods increased most significantly in Turkey - by $55.5 billion, in the United Arab Emirates - by $35.6 billion, and in Kazakhstan - by $10.4 billion.

In total, the countries of the Balkans, the Caucasus and Central Asia, as well as Turkey and the UAE, increased imports by $133 billion in 2022-2023. Nevertheless, $133 billion would be enough to fully compensate for all of Russia’s "losses."

In 2022-2023, its imports from the EU and the United States decreased by a smaller amount of $114 billion due to sanctions.

In two years, Russian business has managed to build an extensive infrastructure to circumvent sanctions. Logistics companies offer cargo transportation through Serbia, Turkey, the UAE, Kazakhstan, and even Saudi Arabia. Business services include warehouses in different countries, repackaging, relabeling, and customs clearance services.

Now logisticians provide customers with the services of controlled companies (for example, in the EU or Serbia), which can make a purchase for themselves and pay for it, and then send it to Russia. Often, goods even travel along old, direct routes - through the Baltic countries or Poland. Such delivery is formalized as "transit", which in fact no longer leaves Russia.

Dual-use partners

In February 2023, after a catastrophic earthquake in Turkey, US Secretary of State Anthony Blinken flew to Ankara. Humanitarian aid, NATO expansion and support for Ukraine were on the agenda.

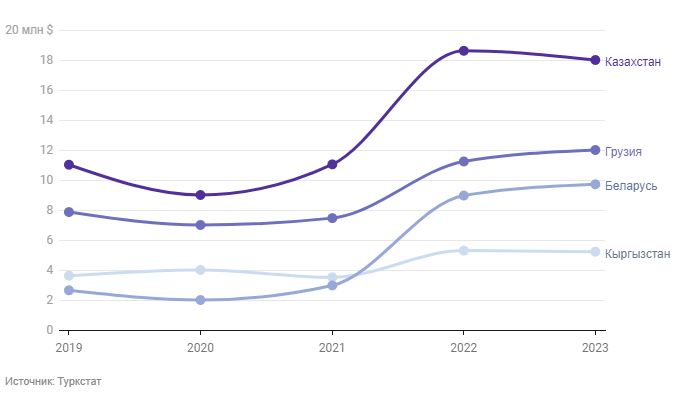

After Antony Blinken’s visit, parallel imports of European goods through Turkey to Russia stopped abruptly. However, the pause did not last long, and deliveries resumed in April. At the end of 2023, exports from Turkey to Russia only increased, according to Turkstat data. It exceeded $10.9 billion. This is almost 90% more than in 2021.

Throughout 2023, representatives of the EU and the United States went on tour and met with the leadership of the countries of Central Asia, Turkey, and the UAE, trying to convince them in one way or another to stop the transit of sanctioned goods to Russia.

From time to time, banks in different countries blocked payments for sanctioned goods. However, judging by the data for 2023, if difficulties were created for Russia, it was temporary. There has been no significant drop in exports of European and American goods, including dual-use goods, our study shows.

We are talking about microcircuits, equipment, machine tools and tools that the United States and its allies consider critical for the Russian military-industrial complex. From these components, Russia produces high-precision missiles, drones, radars and aircraft that kill Ukrainians every day.

How we selected these products

_

To identify dual-use technologies, we used the "List of Priority Goods" – these are 50 codes of goods, the export of which is critically important for the Russian military-industrial complex. This list was agreed upon by the United States, the EU, Japan and the United Kingdom.

_

In the list, goods are divided into four groups, depending on their importance for the production of weapons and whether there are manufacturers on the world market that are alternative to Western ones.

_

The first group includes microcircuits – processors, memory, etc. – the production of which is limited in the world.

_

The second includes electronics, including radar equipment, telecommunications equipment, which is almost not produced in Russia.

_

The third group includes other electronic and mechanical components of weapons: optical, navigation devices, roller bearings, video cameras, antennas, transistors.

_

Finally, the fourth group includes modern numerical control machines and measuring tools.

Most of the countries on our list have been steadily increasing imports of dual-use goods for their needs since the 2000s. To take this factor into account and assess how much the growth in imports can be associated with supplies to Russia, we compared the purchases of goods in 2022 and 2023 not with previous years, but with the trend line.

Only seven countries out of 18 in 2022-2023 reduced or slightly (up to 20%) increased imports of dual-use technologies from the EU and the United States compared to the trend. These are Tajikistan, Turkmenistan, Mongolia, Kosovo, North Macedonia, Moldova and Belarus.

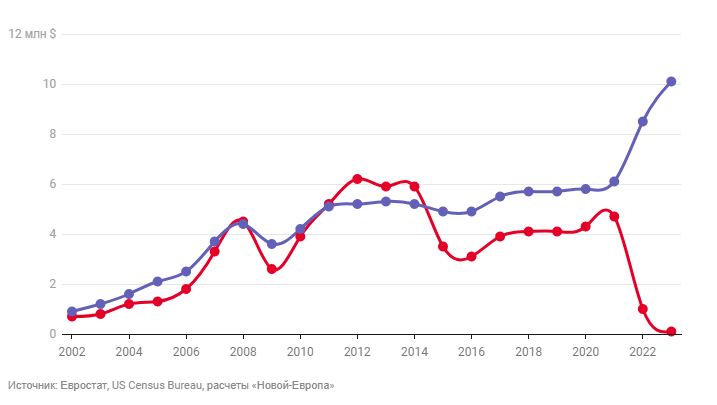

The remaining 11 countries increased imports of electronics and equipment by 21% to nine times. In total, this growth is almost $6 billion. And this is almost equal to the volume that Russia and Belarus "lost" due to sanctions: in 2022-2023, imports of dual-use goods to these countries decreased by $5.9 billion compared to 2021.

Экспорт товаров двойного назначения из ЕС и США в дружественные России страны и Россию и Беларусь

The flow of sanctioned goods consists of dozens of "streams" - bypass routes through different countries. In fact, they are being laid chaotically, under market pressure.

"Everyone is engaged in the supply of sanctioned products and dual-use goods. The infrastructure in Russia that allows us to do this is there, everything is open and official. Anyone can find passages and exits," says the logistician.

"Different logistics companies build their infrastructure [in other countries] depending on who is more comfortable working where, and on the restrictions of countries. They are slightly different everywhere," our interlocutor adds.

As a result, Russia’s neighbors are showing a surprising increase in demand for European and American microchips, optical sights, and machine tools. In 2022-2023, Kyrgyzstan imported 9 times more dual-use goods than the trend followed. Armenia - 3 times.

Kazakhstan - 2.3 times.

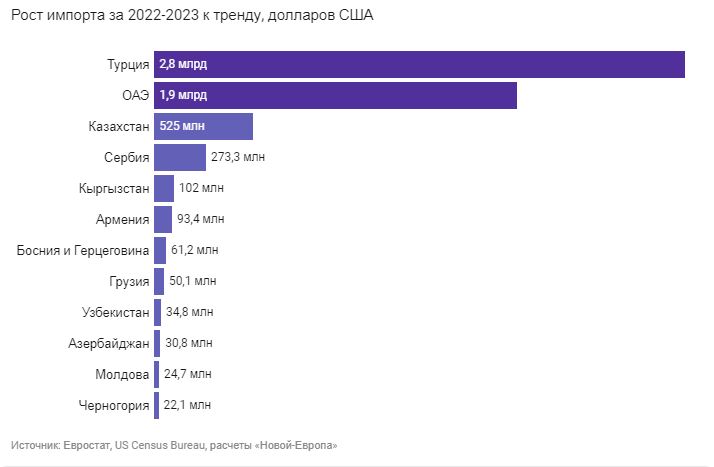

However, other states have become real hubs for the transshipment of critical technologies. In monetary terms, almost 80% of the increased supply of goods for the production of weapons falls on only two countries: Turkey and the United Arab Emirates. In 2022-2023, Turkey imported $2.8 billion more dual-use goods. For comparison, Kazakhstan accounts for only 525 million of growth, and Armenia and Kyrgyzstan account for $90-100 million each.

80% роста импорта товаров для производства вооружений обеспечивают две страны

WERE THESE GOODS SENT TO RUSSIA?

_

It is important to note that we cannot determine exactly what share of the $6 billion in dual-use goods supplies is accounted for by gray imports to Russia. In 2023, many of Russia’s neighbors sharply increased their defense budgets: Armenia (due to the war in Nagorno-Karabakh), Moldova, Turkey, Kazakhstan. Therefore, such an increase may also be associated with the countries’ own needs for weapons. Not to mention the fact that such goods – microcircuits, machine tools – are also used for peaceful purposes.

_

On the other hand, the volume of supplies, on the contrary, may be higher. Dual-use goods can enter Russia through China, Hong Kong, India and other countries that we did not take into account in the analysis. China alone increased the supply of sensitive goods by a billion dollars in 2023, The Bell wrote. And in general, in 2023, Russia restored the supply of critical dual-use goods to 90% of the pre-war level, the International Working Group on Russian Sanctions reported.

_

Finally, here we are talking about only 50 key goods for the production of weapons. These are not all dual-use goods supplied to Russia in circumvention of sanctions. Nevertheless, by circumventing sanctions, Russia can meet a significant part of its needs in weapons components.

Who is good at what

Russian and world media have already written dozens of times about how Russia circumvents sanctions. Here it is buying components for electronic warfare systems. Here is microelectronics for the production of drones. Here are the drones themselves. Here are machine tools for the defense industry.

Countries that have increased exports of goods for the production of weapons even have "specialization". For example, the United Arab Emirates is the leader in the import of goods from the United States. Turkey and Serbia are from Europe.

Not all countries dare to transit to Russia critical components for the production of high-precision weapons - modern memory chips, processors, amplifiers. For example, the United Arab Emirates, judging by the data, has been complying with this part of the sanctions since 2023.

On the other hand, Kyrgyzstan increased imports of microcircuits in 2022-2023 by 42 times, Armenia by 11 times, and Mongolia by almost four times. But Russia’s main friend in the supply of goods for missiles and drones has so far been Turkey, a NATO member. It increased imports of microcircuits by 60%, or $300 million.

The lower the priority of goods on the US list, the more countries are willing to export them. Other electronic components - capacitors and radar equipment - are imported by the UAE, Macedonia, Georgia. Mechanical components – ball bearings, navigation equipment – can enter Russia through Turkey, the United Arab Emirates, Serbia, and Kazakhstan. Finally, the import of modern machine tools unexpectedly increased all the countries of Central Asia: Uzbekistan, Turkmenistan, Tajikistan, Kazakhstan.

"There will always be those who love money"

In March, interruptions in the supply of household appliances Electrolux, Zanussi, Tefal, Braun, Rowenta began in Russia. Manufacturers - the Swedish Electrolux Group and the French Groupe SEB - began to actively block the supply of products to Russia through parallel imports, signing a moratorium with partners in other countries on the re-export of electronics to Russia.

The new practice was most likely a consequence of the 12th package of EU sanctions adopted in December 2023.

"The new measures require companies in EU member states to add clauses prohibiting the re-export of goods to Russia when supplying controlled goods to states that are not members of the Global Export Control Coalition. This commitment only came into force on March 20, 2024," explains Mark Bromley, Senior Research Fellow at the Stockholm Peace Research Institute (SIPRI).

It is possible that these measures will lead to increased sanctions in practice and have a sustained and significant impact on the import of dual-use goods and technologies.

"However, it is a huge task to try to cut off the supply of what is essentially commercially produced and commercially available technology to Russia," adds Mark Bromley.

"It’s time to admit that sanctions are not the way to fight Vladimir Putin" was the title of an editorial in The Economist that came out on the occasion of the second anniversary of Russia’s full-scale attack on Ukraine.

So far, the successes of European politicians have been very limited. In 2023, after an initial surge, Kazakhstan, Armenia and Georgia reduced exports of European chips critical for arms production by a total of 12 million euros. However, in the same year, Turkey and Serbia increased their exports by 93.5 million euros.

U.S. diplomatic pressure seems to be more effective. In 2023, exports of American chips to Russia were reduced by the UAE, Turkey, Azerbaijan, Armenia, Serbia, Georgia, Kazakhstan, Montenegro, by a total of $9.4 million. However, in many countries, it still did not return to pre-COVID values.

Some countries, apparently, cannot be pressured at all. Kyrgyzstan and Uzbekistan are taking advantage of the opportunities that have opened up and are not reducing the export of European and American electronics in any category.

In 2023, the EU Special Representative for Sanctions, David O’Sullivan, visited Central Asia twice and asked not to re-export goods from the "sensitive" US list to Russia. However, the data does not yet confirm success.

Как растет экспорт товаров двойного назначения из Турции

The United States will not be able to completely ban the supply of commercial goods to Russia, but it is becoming more difficult to work, logisticians from Russia admit. Especially because of the latest packages of sanctions.

Companies have to complicate routes. According to statistics, it can already be seen that exports from Turkey to Russia’s neighboring countries have also increased. We can assume that this is part of more complex routes for the delivery of sensitive goods to Russia. Tracking and disrupting such chains of firms and supply seems to be an extremely difficult task.

"Importers are forced to use long chains of companies to exclude the Russian trace of supply, and change the name of products in bank documents. All this makes imports more and more expensive, time-consuming and sometimes even risky," says a participant in the logistics market. "In addition, in the case of dual-use goods, suppliers can sincerely oppose the sale to the Russian Federation. Therefore, in such cases, importers are forced to use even more conspiracy."

In any case, it is even theoretically impossible to stop the supply of mass goods to Russia, economist Dmitry Nekrasov believes.

"If we are talking about some very complex pieces of equipment - turbines for civil aviation aircraft or piece high-precision machines, which produce a thousand or five hundred per year in the world ... If all other sanctions are lifted and only they are dealt with, then, probably, it is possible to stop the export of such goods to Russia. But if we are talking about mass goods, then, of course, not," Nekrasov explains.

All the United States can achieve is a reduction in supplies, but not a complete cessation of them.

"Cryptocurrency and cash, in fact, are not interruptible. Iran used to transport cash by truck. This is inconvenient to export. And why not import it. If you pay more, they will take cash," says an economist from a large Russian university. "There will always be those who love money."